philadelphia property tax rate calculator

The average effective property tax rate in Pennsylvania is 150 but that varies greatly depending on where you live. Be aware that under state law taxpayers.

Philly Released 2023 Property Assessments Here S How To Calculate Your Property Tax Venture Philly Group

3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any.

. For the 2022 tax year the rates are. TAX RATE MILLS ASSESSMENT. Get help with deed or mortgage fraud.

Taxation of properties must. The City of Philadelphia and the School District of Philadelphia both impose a tax on all real estate in the City. The citys current property tax rate is 13998 percent.

Philadelphia property tax calculator pinky extension. 1 be equal and uniform 2 be based on current market value 3 have one appraised value and 4 be deemed taxable unless specially exempted. Check out our mortgage.

You can use this application to estimate your real estate tax under the Actual Value Initiative AVI. Request a circular-free property decal. Then receipts are distributed to these taxing authorities according to a predetermined plan.

Set up a Real Estate Tax payment plan for property you dont live in. Philadelphia County Pike County Schuylkill County Snyder County Somerset County. Heres the formula to calculate a tax bill for a home with a.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Use the property tax calculator to estimate your real estate taxes. Covid vaccine lawsuit update May 11 2022 Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is.

The Actual Value Initiative or AVI is a program for re-evaluating all properties in the city. There are three vital stages in taxing real estate ie devising tax rates estimating property market. Submit an Offer in Compromise to resolve your delinquent business taxes.

The budgettax rate-determining process usually includes customary public hearings to discuss tax concerns and related budgetary considerations. 06317 City 07681 School. For example although Pennsylvania has a 150 average effective property tax rate the rates on a county level vary from as little as 091 to as high as 246.

The current rates for the Realty Transfer Tax are. Under the exempt improvement column 40000 is listed but the 2020 exemption will be 45000. For comparison the median home value in Philadelphia County is.

Buy sell or rent a property. PHILADELPHIA City officials today unveiled a web-based calculator that will allow property owners to see how changes in assessments and the Mayors Fiscal Year 2019. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

Get help paying your utility bills. You can also generate address listings near a. Get home improvement help.

Use the Property App to get information about a propertys ownership sales history value and physical characteristics. The sixth-most populous county in Texas Collin County also has the 15th-highest property taxes. The City of Philadelphias tax rate schedule since 1952.

Philadelphia County collects on average 091 of a propertys. In Philadelphia County for example the. Start filing your tax return now.

Set up Real Estate Tax installment plan.

Guide To The Lowest Property Taxes In Pa Psecu

Pennsylvania Property Tax H R Block

How To Use Rental Property Depreciation To Your Advantage

Personal And Small Business Banking Services Pfcu

Pennsylvania Property Tax Calculator Smartasset

Perry County Pa Property Tax Search And Records Propertyshark

Property Taxes By State How High Are Property Taxes In Your State

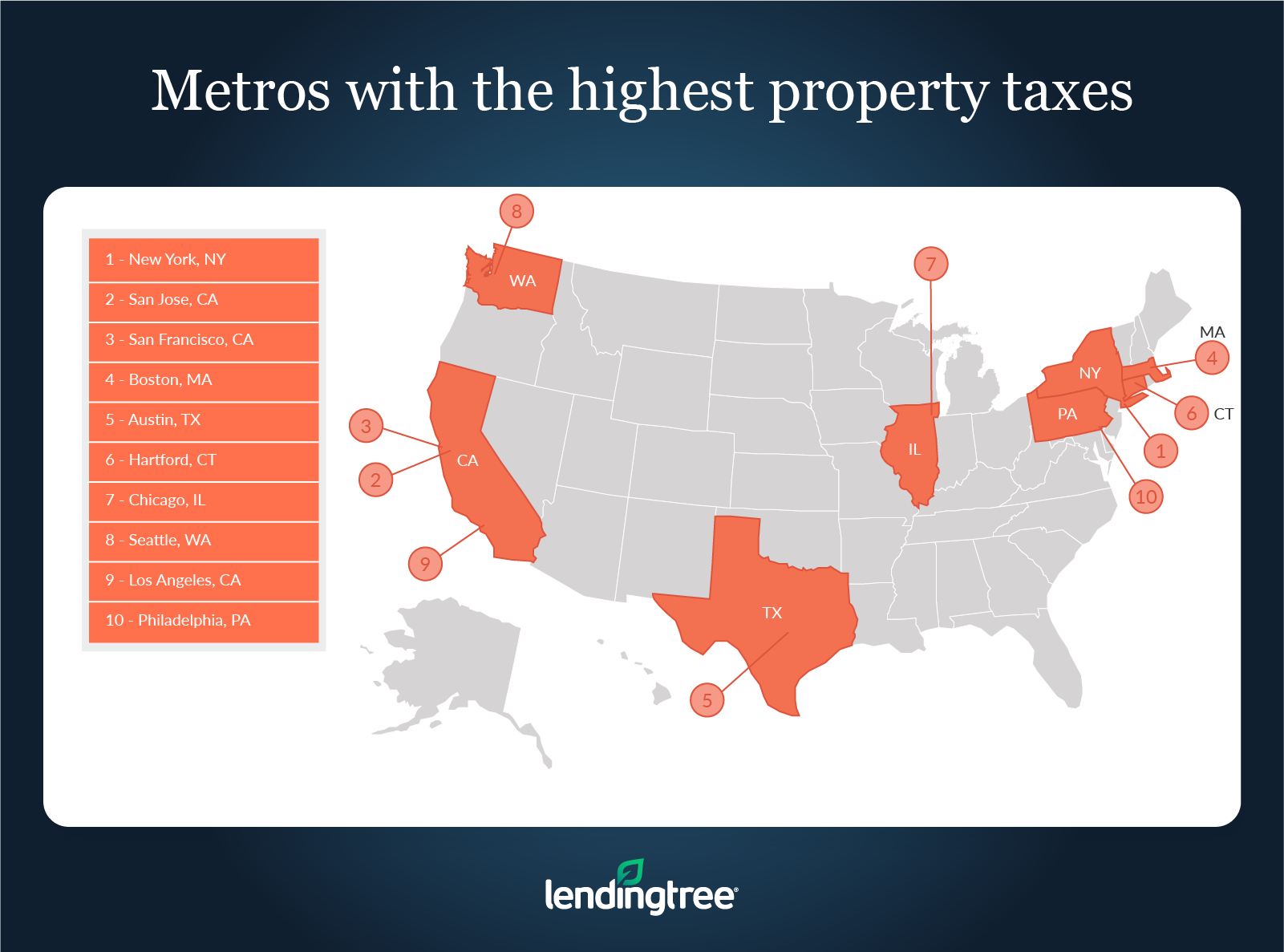

Where People Pay Lowest Highest Property Taxes Lendingtree

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Pennsylvania Sales Tax Rate Rates Calculator Avalara

Guide To The Lowest Property Taxes In Pa Psecu

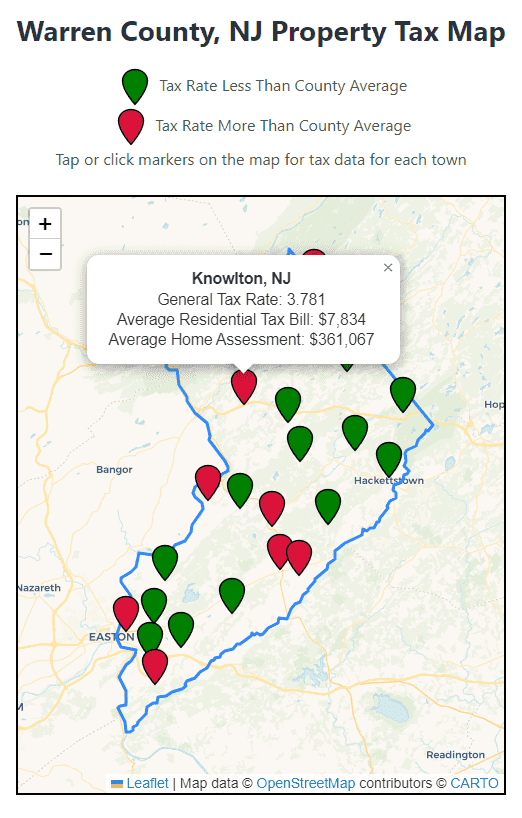

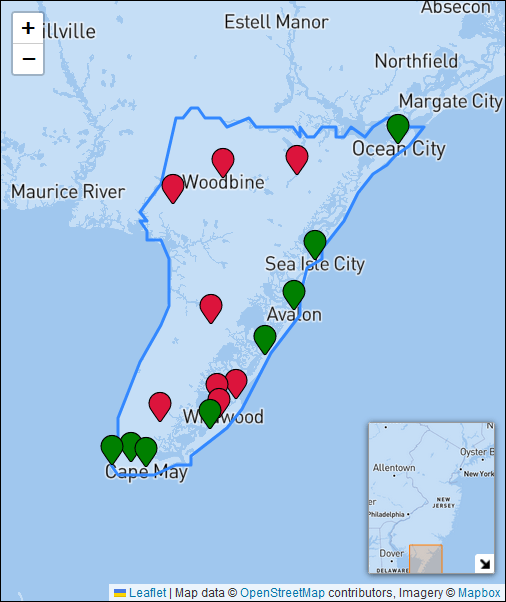

Property Tax Rates And Average Tax Bills For Cape May County New Jersey

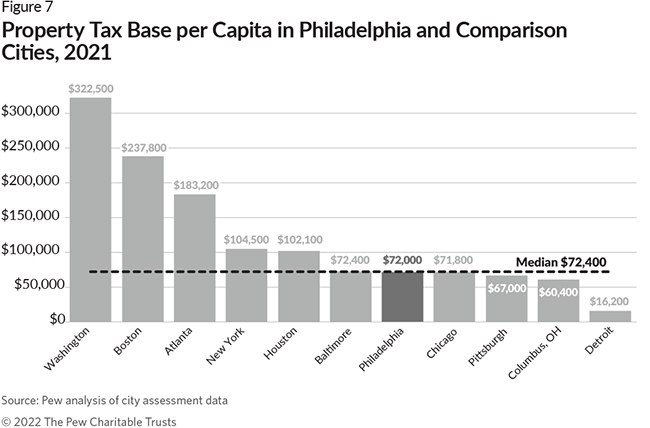

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Philly S 2020 Assessments Are Out Here S How To Calculate Your New Tax Bill

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Philly Property Reassessments Mayor Kenney Proposes Wage Tax Reductions Other Relief Efforts To Counter Spikes In Value Phillyvoice

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Where Do You Get The Most Bang For Your Property Tax Buck In Pa Pennlive Com